The maintenance guy at my old building still makes $45,000 a year. He unclogs tampon-stuffed toilets for people who sometimes spend that much on vacations. I remember him talking about how one of them yelled at him for tracking mud on the hardwood. The mud came from fixing her flooding bathroom at 3 a.m. She didn't mention that part.

That's poverty now. Not just the empty bank account (this guy is doing okay, actually) but the accompanying reminders that you're nothing. The way people look through you. The way they talk slower, like being poor means you're stupid. The security guard who follows you in stores. The doctor who assumes you're just thirsty for those oxycodone pills. The valet who's ruder because your car's a Nissan Altima.

I know a substitute teacher with an MFA who drives Uber after school, delivers food on weekends, writes thumbsucking hot takes at night, and still can't make that New York rent. She parks so she’s not showing the smashed-in side of her car when she picks up passengers from nice neighborhoods. Parks around the corner from restaurant pickups so they won't see her hanging bumper. She used to teach full-time until budget cuts. Now she assures me she’s one car repair away from homelessness. Is she? The owl of Minerva flies only at dusk.

The algorithms seem to know you're poor before you do. Your credit score interfaces with every other system. Can't get an overpriced apartment without 700+. Can't get a job without a credit check. Can't fix your credit without money. It's a beautiful closed loop designed by people who've mostly never been inside it and a few who were but are more than fine with slamming the door on the rest.

The Church of Money

We sometimes discuss rich people like they're different species. Some dropout makes an app that tracks your bathroom habits via bluetooth diapers, period pads, and tampons, sells it for $50 million, and suddenly he's a "visionary imagineer." Never mind that he just repackaged someone else's Github work and slapped a portmanteau company name ("DiaPeriodizeAI") printed in Garamond on it. Never mind that his dad's VC friends funded it. He's in Forbes' 30 Under 30, giving TEDx talks about "disrupting the disruptors" in the "wellness space," citing revenue numbers that might not be made up but probably aren’t real either.

Meanwhile, the woman who's cleaned his dad’s office for ten years — who has who raised four kids alone, who has never missed a day of work — she's invisible. Makes $20 an hour. Health insurance with deductibles higher than prime-period Hunter Biden. Takes two trains to get there because parking costs more than she makes in three hours.

The rich get platforms to share their morning routines. "I wake up at 4:30 and meditate." They don't mention the au pair who's been up since 4:00 with the snot-nosed trophy kids they spent $100,000 conceiving. "I do intermittent fasting." They don't mention their private chef who plans their one meal that breaks that fast. "I train for two hours every morning." They don't mention that most people's two hours are spent commuting, usually on very unreliable light mass transit (like Raleigh’s Capital Area Transit (CAT) buses, affectionately known as the "city kitty" before the 2015 rebrand).

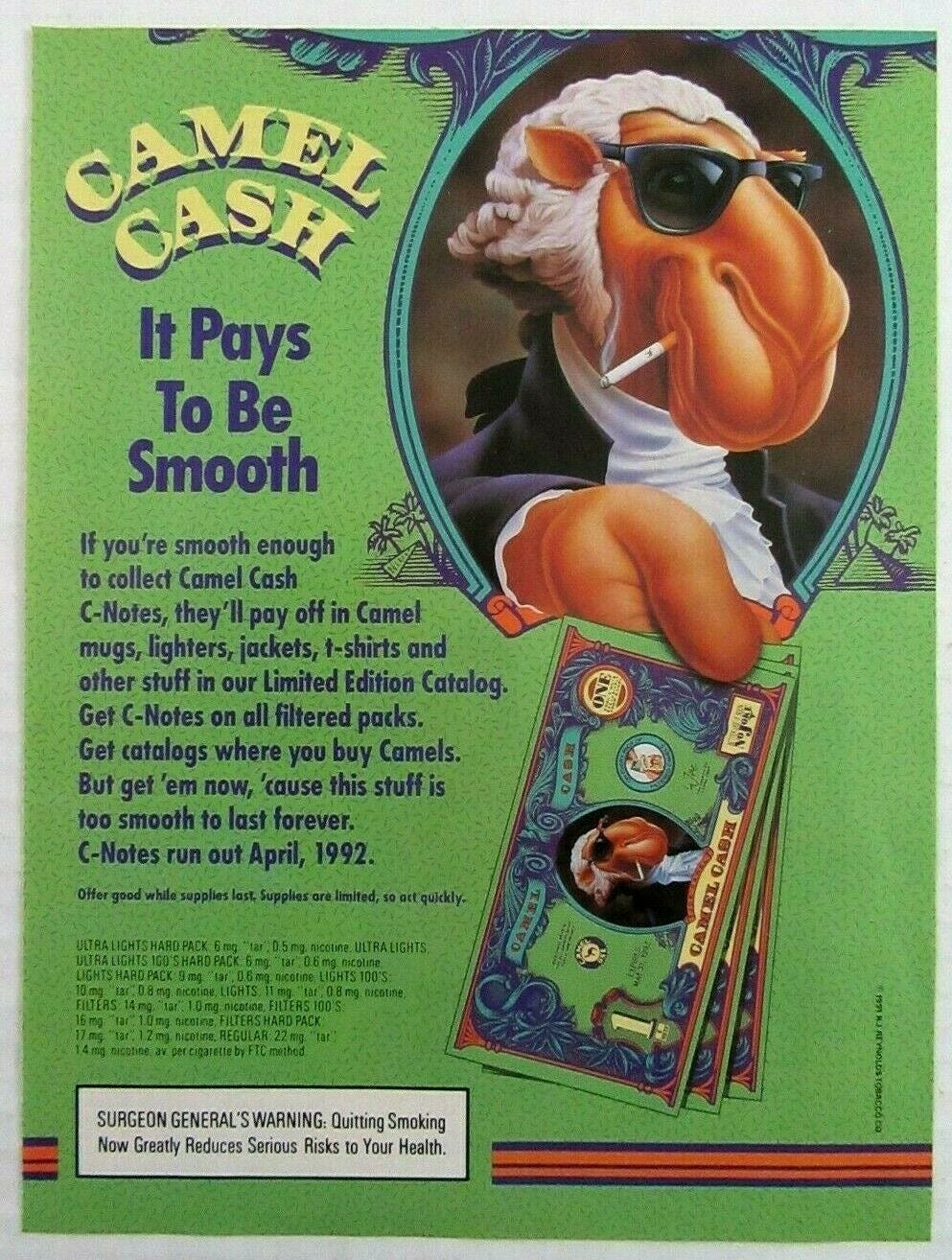

Watch how money changes the language. A rich person is "eccentric." A poor person is "crazy." Rich people "invest." Poor people "gamble." Rich people have "substance issues." Poor people are "addicts." While they doomscroll on their imported Huawei phones, rich people are said to "network." Poor people "waste time" on their various prepaid burners. The behavior's the same. The bank balance makes all the difference to us humanzees.

Specific Humiliations

Overdraft fees are a special kind of modern poor tax. You're broke, so the bank charges you $35 for being broke. Then another $35 when the next automatic payment hits. Then another. By Friday you owe $175 in fees on $50 worth of transactions. The bank made more money off your poverty in a week than you made working.

The laundromat is social control. Two hours every week, $20 in quarters, sitting on plastic chairs that haven't been cleaned since Reagan was president. The rich don't think about laundry. It appears clean in their closets. The poor might plan their whole week around washing machines.

Food deserts are real. The bodega charges $7 for milk and $11 for eggs because they know you don't have a car to drive to the supermarket. The only vegetables are onions and potatoes. The fruit is brown. Everything else comes in boxes or cans. Then they wonder why poor people are unhealthy.

Dollar stores offer predatory pricing for consumer goods. That laundry detergent is cheaper per ounce at Target, but you need $15 for the big size. You've got $5, so you buy the small one that costs more per wash. Being poor is expensive.

The ER is your doctor because you can't afford a real one. Six-hour wait to get antibiotics for the strep throat you ignored until it was too late. They treat you like you're drug-seeking. Send you a $3,000 bill for what would have cost $100 at urgent care. It goes to collections. Your credit gets worse. But at least you’re still alive and you can’t go to prison for non-payment! The cycle continues.

Death and Money

A good friend’s neighbor died last month. Heart attack at 52. He'd been having chest pains for weeks but kept working. Self-employed doing nothing in particular except posting on Facebook (I was a "friend" there), seemingly no insurance to speak of. His daughter set up a GoFundMe for the funeral. Raised $3,000. Funerals start at $8,000. They cremated him and called it a day, which is an increasingly popular means of wrapping things up in 2025. Let the dead bury the dead.

Rich people die differently. Private rooms, experimental Bryan Johnson-esque treatments, teams of specialists. They’re not immortal yet, but they can usually buy time. Poor people get morphine and a social worker asking about end-of-life plans. North of the border they might even be able to get euthanasia ("It isn’t just a bunch of young kids in Korea anymore," as my old man used to joke back when he wasn’t dead). Rich families fight over inheritances. Poor families fight over who pays for the pizza.

The grief is the same but the aftermath isn't. Rich widows have lawyers and financial advisors. Poor widows have eviction notices. Rich kids inherit portfolios. Poor kids inherit debt collectors calling about their dead parent's medical bills (you don’t have to pay them).

Losing Everything

The aspiring business owner who put everything into a restaurant. The food wasn’t half bad, but COVID killed it in three months. Thirty years of savings gone. Now he's a line cook at Applebee's. His wife left. His kids won't talk to him. He still lives in the apartment above his former restaurant, watching someone else's name on the sign. Could be worse — he could have cancer!

The teacher who invested her pension in her brother-in-law's "sure thing." Some patriotic crypto scheme that was "going to the moon." It went to zero instead. She's 65, starting over, substitute teaching and stocking shelves at Target overnight. Her retirement plan is dying at her desk, but at least she’s got a plan.

The small-time contractor who bid too low on a big job. Fronted materials, hired crews, did the work. The client filed bankruptcy, as clients are wont to do. Stiffed him for $200,000. He lost his house, his trucks, his marriage. Lives in his sister's basement. Sizzurps himself to sleep remembering when he had a couple of employees. Better a has-been than a never-was, the old saying goes.

The couple who refinanced during the bubble. Adjustable rate mortgage. "Housing always goes up."Not a bad gues until the 2008 meltdown happened. Underwater by $150,000. Strategic default. Seven years of credit hell. Now they’ve got Cricket Wireless and rent a place smaller than their old garage. Last I checked, they still have each other.

Love and Money

Consider this case study in true love: She married him when he was pre-med. Supported him through school, residency, fellowship. Worked two jobs so he could study. The week he bought out his partner at the practice, he served her with divorce papers. His lawyer argued she wasn't entitled to alimony because she had a college degree herself and had "chosen" to work low-wage jobs. She couldn’t afford her own to engage in lawfare because he had smartly cleaned out the bank account before he made his move.1

Or this one: He married her for her father's money. The father died, left everything to charity. She turned drugged-out and weird, he got mean and fat. They stay together because they’re both smart enough to know that the best family lawyers specialize in draining family fortunes, Bleak House-style. Better to sleep in separate rooms in a McMansion they very nearly can't afford, perform happiness at dinner parties, and hope the other dies first.

The dating apps are wealth filters now. "Must be financially stable" means six figures. "Ambitious" means rich or trying. Everyone's lying about their job, their car, their zip code. First dates are job interviews. "So what do you do?" means "Can you afford me?" Probably not with the way this economy is going!

Poor people date differently. You can't go to nice restaurants. Can't take vacations. Can't split bills because you're both counting quarters. Your dates are walks in the park, YouTube on a laptop, gumming dry cubes of ramen together. If it works, maybe you get laid. If it doesn't, the subsistence demands of tomorrow ensure you’ll soon forget yesterday.

Modern Terrors

The notification that says "Low Balance Alert." The email about "unusual activity" on an account you forgot existed. The certified letter you're afraid to open. The voicemail from an unknown number that's definitely a collector. The knock on the door that might be eviction.

Nearly everyone's three bad months from disaster. The secure job that disappears in one of these AI restructurings today’s jargon-spewing business leaders love so much. The health insurance that denies your claim. The car that dies with negative equity on the loan. The tooth that needs a root canal you can't afford. The pet that needs surgery or euthanasia.

The spreadsheet or budget tool where you try to make it work. Rent, car payment, insurance, phone, utilities, food. No matter how much do re mi you’re working with, you know in your heart that the numbers will never add up right. You cut everything. No streaming services, no coffee shops, no restaurants. Still short. You download cash advance apps. Payday loans with prettier interfaces. The hole gets deeper.

The friends who ghost you when you're broke. Can't go to brunch, can't do drinks, can't chip in for the bachelor party. They stop inviting you. Say they didn't want to "make you uncomfortable." You see their Instagram stories from places you used to go together. They're uncomfortable, not you.

The Protection Racket

After that insurance CEO got murdered in Manhattan, we saw how fast the narrative changed. Suddenly every LinkedIn "strategist" and "start-up addict" who spent the last decade at $500-a-plate dinners discovered their deep compassion for "job creators."2 The same people who would shrug when informed that poor people die from coverage denials were posting symphonies of ChatGPT-generated grief for a man who made a cool couple million a year stymying those claims.

"He was a father," many said. Like the 68,000 people who die each year because they can't afford healthcare weren't fathers, mothers, children. "He was just doing his job," they said. Who isn’t? "Violence is never the answer," they said. I suppose that depends on the question.

Watch these comfortable sorts — the ones who got their jobs through connections, who've never worried about a medical bill — suddenly demand nuance. The CEO was a "complicated man" who "worked within the system." He "created value for shareholders" through a creative approach to processing claims (deny as many as possible!) while trying to fashion humane alternatives (eventually). The same columnists who willing to praise street protestors on the left or right who are far from their homes but beneficial to their political bottom lines now write think-pieces about "dangerous populism."

The Wall Street Journal editorial board member who owns three houses wants you to know that billionaires are "wealth creators." The Times writer with the trust fund spouse explains how CEOs "bear tremendous responsibility." The magazine editor who summers in the Hamptons writes about the "unfair demonization of success." They all went to the same schools, live in the same neighborhoods, go to the same parties. Class solidarity is real — just not for your class.

They're especially worried about the online reaction. All those ungrateful poors celebrating, making jokes, refusing to mourn. "What has happened to our civility?" asks someone who just wrote a column defending companies that charge megabucks for insulin.3 "We're losing our humanity," says someone who thinks $7.25 is a living wage. "Why are people always picking on millionaires and billionaires? They’re the only ones doing anything right," points out a third.4

The Poverty Zoo

But here's where it gets really interesting. Many of same people who defend the rich love poverty when it stays in its cage. They write loving profiles of "authentic" communities. The "vibrant" culture of the projects — "50% of the kids are illegitimate, but when they get married, they really get married! Love those hats and that soul food spread."5 The "rich traditions" of the working poor. As long as you stay there.

Let a poor kid get into Harvard, start wearing a bowtie, and suddenly he's "forgetting his roots." Let someone from the projects become successful and they're "acting bougie" or "selling out." The comfortable classes love poverty as an aesthetic, as a source of stories, as proof of their tolerance. They just don't want you getting uppity. Don’t want you saying that povety sucked and you want to be as far from it as possible in the future.

I know a woman who grew up in the Bronx, first in her family to graduate college. Works in finance now. Coworkers occasionally ask her about her "journey" but get uncomfortable when she says she hated being poor, is glad she’s making good money now, and wants nothing to do with other poor people. They want her to say it built character. Made her stronger. Gave her perspective. She tells them it was just a load of crap.

The conservatism of fake progressives is amazing. They'll write detailed ethnographies depicting drug dealers as "entrepreneurs" but attack the kid who leaves the neighborhood and not only doesn’t write some cheesy Hillbilly Elegy tract but never looks back at all. They'll romanticize "community solidarity" that's really just shared misery. They'll criticize people for wanting better schools, safer streets, actual opportunities. "Gentrification," they cry, from the stoops of their brownstones.

Writers who cater to these people visit poverty like a safari. A few of them do their "immersion journalism" for a month, live on minimum wage, write about how hard it is. Then they go back to their real lives and win awards for their "brave" reporting. They want the poor to perform poverty for them.6 Stay colorful. Stay authentic. But most importantly: Stay where you are.

The movie version of poverty. The noble struggling mother. The kid with a heart of gold. The toothless old wise man on the stoop. Everyone's got dignity and pride and community. Few if any of these people exist. If they do, the mother’s a junkie, the kid’s a bully or a kleptomaniac, and nobody under 18 would be advised to follow the old man back to his room at the YMCA. Nobody mentions the stress, the violence, the hopelessness, the addiction, the bitter competition for scraps. That's not the poverty they want to see.

When someone escapes poverty and tells the truth about it — that it's not noble, that they don't miss it, that they're glad their kids won't know it — these folks clutch their pearls. How dare you not be grateful for your hardship? How dare you not want others to experience it? How dare you break the narrative? I endured a few years of genuine want after a decade of plenty. All I care to say about the experience, aside from the fact that such deprivation will always be with us, was articulated three decades ago by canceled creator John Kricfalusi’s Mr. Horse: "No sir, I don’t like it." The rest, like the things I’d do to avoid ever falling back into that state, are best left unspoken.

The Final Bill

Poverty isn't just financial. It's cellular. The stress hormones that never stop. The sleep you don't get because you're calculating bills.

It ages you faster. Poor people look older because they are older, biologically. Their telomeres are shorter. Their organs more damaged. Chronic stress is chronic disease. Poverty is a pre-existing condition and those born into it are terminal cases.

The inspirational stories about people who "made it out" miss the point. For every one who escapes, hundreds of thousands don't. Not because they're lazy or stupid or uncommitted. Such adjectives are meaningless here. No, it’s because the system needs poor people. Someone has to clean the toilets, deliver the food, watch the kids, work the night shift. The rest serve as the lumpen ballast that lines the basest base of the body politic.

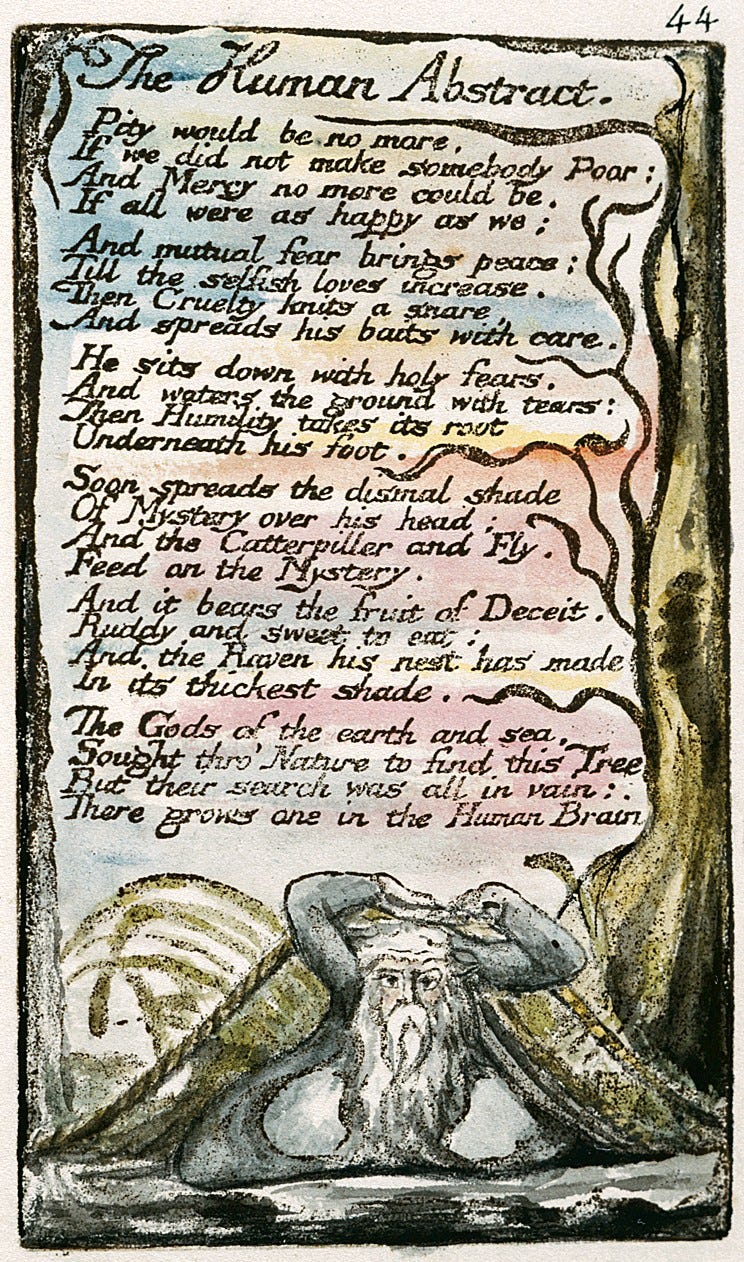

The rich need the poor to exist so they can feel rich. It's relative. Take away poverty and wealth loses meaning: "Pity would be no more/If we did not make somebody poor," as William Blake wrote centuries ago. So, almost unthinkingly, decisions are made that ensure poverty continues. How could they be made otherwise, really? Cut education funding. Oppose healthcare. Kill unions. Automate jobs. Do all of this without even giving the slightest thought to whatever pittance of a UBI might be needed to ensure the entire edifice doesn’t collapse on us. When pressed, find extremely polite and roundabout ways to simultaneously blame and praise the poor for being poor.

"Money doesn't buy happiness" is something people with money say. Like "looks don't matter" from pretty people. Or "size doesn't matter" from... never mind. Money buys choices. Choices create happiness. Or at least the chance at it. And size of all kinds certainly matters.

Your relative lack of wealth is someone else's profit margin. Your misery is someone else's moral superiority. Your authenticity is someone else's entertainment. Remember that next time they tell you to be grateful for the struggle. Grateful? The work is the work — for most of us humanzees, there’s certainly no end to the hewing of wood and drawing of water — but it sure as heck isn’t play.

My own legal advice, offered free of charge: Ask for forgiveness, not permission, and pull that trigger with all deliberate speed if you’re in the same boat.

By contrast, you’ve got a host of creators, like ???-year-old journalist-turned-Substack-busker Taylor Lorenz, who would probably offer their hands in marriage if the alleged murderer asked for it.

This interview about insulin pricing in the USA bears a close read.

To be brutally honest, in the game of social Darwinism — the only game in town — they’re not wrong.

That line is actually from this hilarious scene in William Klein’s Mr. Freedom (1969).

One of the most accessible books on class you’ll ever find is Class Matters (2005), a collection of some of the NYT’s best reporting on the subject.

People that say money doesn’t buy happiness need to spread this message to homeless camps. …yes when all your needs are met you get bored and feel empty. We all know this. It isn’t wisdom. See every single leader. You need other things in life outside of money but money pays for housing, food and resources. It doesn’t pay for meaningful friendships.

Another handsome piece, mister fella!

All spot on. I somehow saw it coming in the mid-1980s and made it out by way of an old apartment with a heavy bolted door, a big Norwegian forest cat, an unnatural ability to work full time while going to school full time, an aptitude for entrance exams, and more luck than I deserved. I was the last one on the bus out of my neighborhood -- one that sounds a lot like the one you are describing. And no, I'll not go back (got a case of dynamite -- I could hold out here all night).